Show me the money! How to financially justify maintenance projects to top management

Maintenance is complicated business. As shown during the Q&A sessions at the last Annual Process Industry Engineering & Maintenance Congress (held in Shanghai on September 19-20), many maintenance managers are at a loss when faced with the need to financially justify their decisions. The fact is that, when a project is presented for approval to top management, some form of financial justification is normally required.

More often than not, technical managers simply back down and prefer not to propose the project at all. The frown on their bosses face and the inevitable question “can we manage without this?” (the answer of which is, almost invariably, yes) often end discussions before they even really start. They feel they cannot commit to specific savings – “we are not 100% sure we can achieve this”. They think that most maintenance actions are justified by risk avoidance (the prevention of possible – not certain – losses) rather than hard financial numbers. They fail to understand that in today’s financial driven world, their boss does have to make such commitment (revenue and cost forecast, budget, performance targets etc.) and that everyone knows that there is no 100% certainty that projected figures become reality…

Financial figures related to past disastrous breakdowns (for example revenue losses due to a prolonged production stop a few months before) may be available – but they do not necessarily represent future savings. On the other hand, direct maintenance cost may not be a reliable indicator of improvement. Here is a real-life example: one of our largest customers in China called us for an audit when the CEO found they used less than 50% of their maintenance Capex – what was thought as a great cost saving in a time of crisis ended up putting the entire business at risk!

As a result, maintenance departments very seldom innovate or drive new improvement initiatives. Improvement projects sometimes emanate from top management instead, in a top-down approach, the maintenance team simply executing orders. In the example above, plants managers desperately cut costs and the group CEO has to involve to actually raise maintenance cost to improve performance.

Once understood that ROI estimates do not have to be accurate predictions (no such a thing exist), but are rather a normal step in the corporate approval process, it is possible to approach the question in a systematic manner. Here is what we recommend:

1 – Perform an assessment of current situation to identify potential savings

2 – Study the ROI obtained in similar projects elsewhere

3 – As part of the project implementation, work in a controlled manner to reduce risk

2 – Study the ROI obtained in similar projects elsewhere

3 – As part of the project implementation, work in a controlled manner to reduce risk

The three approaches usually need to be combined: one of them won’t be enough.

1 – Perform an assessment of current situation to identify potential savings

In the specific context of China, assessing possible ROI is often simpler than one would expect, as maintenance tends not to be optimized: there is a lot of room for improvement. This is not something negative, on the contrary: we, the maintenance people, can have an enormous impact on the company’s performance. We should be glad!

In typical plant organizations, with relatively few employees, ROI will most likely come from avoiding loss (the bottom part of the iceberg below). In larger organizations, such as maintenance service suppliers, direct cost savings may be the main driver. Having said that, the situation differs from one client to another, depending on the type of facilities maintained, their age, the size of the organization and its specific problems. As a rule of thumb, remember the shape of the iceberg – even in the highly optimized Western economies, the ratio between indirect vs. direct savings (respectively the bottom and top part of the iceberg) is over 7 (typically more than 10 in China).

Maintenance Iceberg

Most Siveco projects start with an initial assessment, either a brief site visit resulting in rough potential benefit estimates, or a more comprehensive audit (which could take several weeks of work) leading to a more complete ROI study. How comprehensive the assessment should be depends on how ROI-driven the organization is (how deep should we go into possible savings estimates) and how much money can be put upfront for such a study (which is not free, this is real high value-added expert consulting that very few companies can perform in China).

An example from an automotive supplier located in Wuhan, showed possible savings from refocusing the maintenance team on preventive maintenance rather than “firefighting”, a model than had proven costly in terms of losses.

Examples of the automotive supplier report

Realistic improvement goals in terms of preventive maintenance ratio and the resulting breakdown reduction, led to 375,000 RMB expected savings in the first year for the existing plant or 750,000 RMB if including the new phase-2 plant. This did not take into account reduction of production losses and optimization of spare parts and procurement, where problems were known to exist but hard to quantify. Another estimation method was then used, showing consistent figures (300,000-450,000 RMB) thus validating our numbers. The maintenance improvement project was then scoped to achieve ROI within the first year.

Another example of a more comprehensive audit (one week onsite with two engineers working together with the various departments at the plant) at a paper making plant showed obvious justification for a project, which immediately convinced the board of directors to approve the project.

Examples of the paper plant report

By implementing a robust preventive maintenance program (as compared to almost no preventive maintenance today), the team calculated avoided losses worth 2.23-3 millions RMB per year, more than enough to fund the maintenance improvement project. In addition, a “residual value” for the project was calculated, in terms of direct savings in a future IT project (SAP PM implementation, savings in consulting fees and implementation time), covering over 50% of project cost.

2 – Study the ROI obtained in similar projects elsewhere

Various solution and service vendors may present ready-made ROI figures (example 15-30% reduction in spare parts cost), often totally disconnected from industrial reality: for us in China, a clear indicator of irrelevance is when figures are quoted in USD (when was the last time you purchased anything in USD in China?) or based on overtime reduction (does your company even pay overtime?). A few years ago, we ran web searches on content from CMMS supplier’s presentations, only to find their ROI figures were cut and pasted from articles on the internet… We encourage clients to take such “ROI” with a grain of salt!

On the other hand, it is not easy to get existing customers to measure and publicize the ROI obtained on their projects (this is related to our third item: “As part of the project implementation, work in a controlled manner to reduce risk”). At Siveco, we systematically encourage customers to do so. After years of efforts, we now have a have a nice database of customer stories, many with clear benefit statements, and more and more with accurate ROI figures.

This section summarizes recent examples of ROI calculated by our customers:

Changcheng Property Group (CCPG), a large facility management company operating out of Shenzhen, manages residential and commercial properties all over the country. For more information on this client, see the case study already published. CCPG has calculated the direct savings achieved with our project, based on implementing our web and mobile solution bluebee® (which they call “PMS” for Property Management System):

– 30 millions RMB/year in labour cost (labour represents 70% of their operation cost).

– Indirect savings are harder to compute: increased quality of service, support for business growth and to provide new services (e.g. energy services)…

– Indirect savings are harder to compute: increased quality of service, support for business growth and to provide new services (e.g. energy services)…

Remember this is a service company, they do not own the assets they manage hence business losses are not their direct concern (for example asset replacements are the owner – CCPG’s customer – responsibility; savings achieved by the owner thanks to CCPG’s improvement program is hopefully translated into better profit margins for CCPG). The experience of CCPG is typical of efficiency savings that can be achieved by large multisite organizations.

Another type of customer is Shanghai Essilor Optical, a manufacturer of ophthalmic lenses. See this article for more background. This is what Essilor has achieved in the past two years:

– MTBF +30% in two years

– Downtime first year -13%, second year -38%

– Downtime first year -13%, second year -38%

Due to confidentiality reasons, we cannot elaborate on the indirect savings (losses avoided) linked to these reliability improvements, which would involve multiplying downtime reduction by downtime cost/losses… You could take your own production figures and do a calculation to obtain financial values.

– Monthly cost (except labour, which is stable): from 802k in 2011 (19% attributed to Preventive Maintenance) to 580k in 2012YTD (with 43% PM). This proves that PM ultimately costs less than corrective maintenance, although an initial effort is required. Assuming the trend continues that’s 2.6 millions RMB saved compared to the previous year…

In this case, indirect savings (losses avoidance) represents the bigger ROI. However, direct savings are always easier to measure! This is one of the many paradoxes of the maintenance business… Don’t be fooled by this and do not focus on direct costs!

Nokia Beijing is a large manufacturing facility making mobile phones. This customer story details the company and project background. The project was run in a strict phased approach, with ROI measurement and no/no-go decision at each phase. These are the results obtained from the first phases:

– Downtime rate reduction by 15% (target was 7%)

– MTBF increase by 12.7% (target was 5%)

– Inventory accuracy increased from 67% to 96% (stock value remained stable)

– MTBF increase by 12.7% (target was 5%)

– Inventory accuracy increased from 67% to 96% (stock value remained stable)

As a company like Nokia is naturally very secretive with their financial information, we don’t have the downtime cost that would allow us to calculate savings (I reckon our readers could make their own estimates). A very rough calculation only taking into accounts the time saved by production operators adds up to 500k RMB per year – this is really the tip of the iceberg.

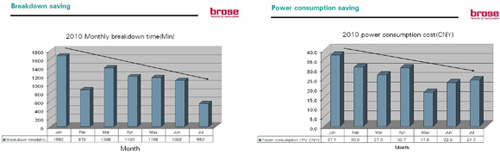

Brose Wuhan, a supplier to the automotive industry, showing they obtained ROI in less than a year through energy savings alone. A summary of the project was published here. Figures from the financial department (typically conservative) show a sharp decrease in energy consumption as well as downtime, equivalent to ROI for the project within one year.

The calculation doesn’t take into account less measurable objectives of the project, related to maintenance preparedness for increased production volume, which would have been unmanageable with the previous maintenance organization. This is an example of direct payback (easy to measure energy bill reduction) – nice to have but not the real objective of the project – with much larger, but not measurable, risk-related benefits – the actual objective from a management standpoint. Without direct savings however, the project would have been much harder to justify…

3 – As part of the project implementation, work in a controlled manner to reduce risk

The few examples above show customers who have made the effort to measure the results obtained during the project implementation. All the above are our customer’s own numbers, not ours: this is not marketing, but reality. Although some of our customers are reluctant to talk about ROI, for various reasons, we always encourage them to do so!

This leads us to the last section of our article: how to manage projects. In order to reduce project risk, and thus more easily secure top management approval, we suggest our clients to break-down their improvement projects in phases, each with a clear scope and measurable goals. At each phase, a no/no-go decision is made whether or not to continue, which considerably reduces risk for the customer. The Nokia project is a perfect example of this approach (see link to full case study in the second section).

We note that this phased approach runs counter to the typical engineer’s mindset, which is to cram as much functionality, as much scope as possible in a project. It also conflict to what most procurement departments want, i.e. price reduction. For example, if the improvement project is based on the implementation of a CMMS, with a first phase focused on recording breakdowns (cause, impact), engineers may also want to have work management, planning functionality and other gimmicks unrelated to the first phase improvement goals. Procurement on the other hand may not care about ROI at all, only price – regardless on negative consequences on ROI. For such a project, the scoping and contracting process should be kept under control by top management, i.e. by those with a clear understanding of the project goals.

In summary

Our experience shows that the best way to launch a maintenance project is for the maintenance manager to propose a ROI-driven approach to his top management.

– This should be based on an initial assessment, presented to top management, backed by similar experience in other companies in China.

– The figures may not have to be accurate – they are only estimates, which top management should be able to understand (their own targets, budgets, etc. are also estimates) – but they have to be realistic.

– We recommend targeting ROI within a year.

– The project itself should be structured to reduce risk, split in multiple phases, each with clear measurable goals.

– The figures may not have to be accurate – they are only estimates, which top management should be able to understand (their own targets, budgets, etc. are also estimates) – but they have to be realistic.

– We recommend targeting ROI within a year.

– The project itself should be structured to reduce risk, split in multiple phases, each with clear measurable goals.

If you are a maintenance manager, we can help you through this process and assist you in talking to your top management.

If you are a top manager, we can coach your team to go through this process and help them come up with improvement suggestions instead of being only reactive.