Chinese vs. multinational companies, a further look at the “Maintenance in China” survey

This month’s Reliability article is a follow-up on the 2012-2013 “Maintenance in China” survey report which was released last month (summary here and full report available upon request).

Since we have received a number of enquiries regarding the differences between Chinese and multinational respondents, we decided to elaborate on some of the differences in this article.

A key finding from the survey was in fact that nationality does not have such a very significant impact on responses, except in a few specific area listed below, which can be considered relatively minor but nonetheless may present some interest.

Local respondent profiles

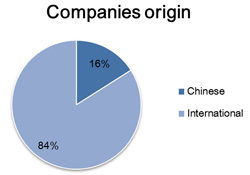

Analysis of respondents shows that only 16% were local Chinese companies. 84% were multinationals, mostly of Western origins. The bias towards international companies was attributed to the survey distribution process, mainly conducted through international business associations.

Local companies that responded are all large scale manufacturers, equally split between chemicals and large equipment manufacturing, mostly State-Owned Enterprises and a few large private companies (arguably with strong government links). Some of those are Siveco customers and most already took part in previous surveys, which means we have access to additional data for a more in-depth analysis.

Outsourcing trends

Chinese companies indicate they outsource on average 7% more than their multinational counterparts which is partly explained by outsourcing to related companies (specialized companies within the same group, often departments that were recently spun off).

Experience shows however that state-owned companies are less likely to outsource maintenance to truly independent third-party service suppliers, as they may not be willing to reduce headcount or to transfer employees to the private sector.

Based on observations from the Chinese energy sector, which has longer history setting up dedicated maintenance subsidiaries, the spun-off maintenance divisions of major industrial players may become sizable services providers in their industry segment or geographical area.

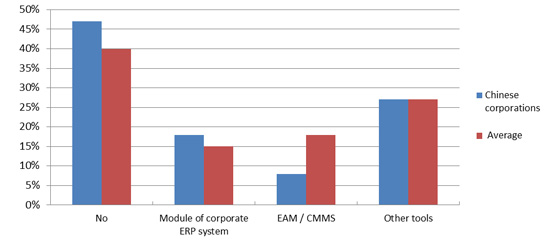

Use of computer support systems

More Chinese companies (47% vs. 40% for the entire respondents’ database) report they do not use any computerized system to manage maintenance.

The rate of CMMS/EAM penetration among Chinese companies is approximately half the rate among multinationals, at only 8% vs. 18% on average. Considering Chinese respondents are on average much larger and more asset-intensive firms than their western counterparts, CMMS/EAM penetration can still be considered very low.

On the other hand, local companies report a higher rate of using the maintenance module of their ERP system (18% vs. 15%).

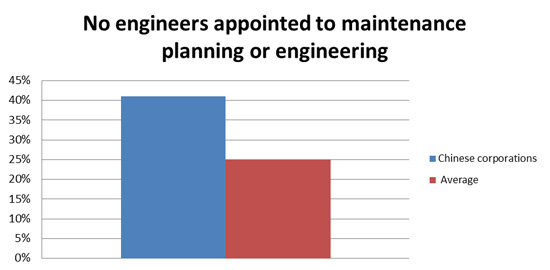

Maintenance planner or engineer

A comparison of the staffing figures, adjusted for companies size (local respondent end to be much larger companies than their western counterparts), show that a much higher percentage of Chinese firms have no engineer appointed to planning activities (41% vs. 25% for the entire respondents database).

A rapid cross-checking of answers for respondents that Siveco knows well shows the figures may be underestimated, but they reflect ambiguity as to the role played by “Equipment departments” in Chinese organizations. While such department should lead maintenance engineering and planning activities, it is often disconnected from operations and focused instead on procurement or documentation, while separate maintenance units perform day-to-day activities. For this reason, this difference was not included in the survey report.

Conclusion

All-in-all, while some of our readers were surprised to see so little difference between local and multinational companies, it was not a very big surprise for the Siveco team. In spite of different “cultural” or “historical” outlooks towards maintenance, both Chinese firms and multinationals face the same fundamental challenges… and the same opportunities.

In fact, it is Siveco’s experience that the strong corporate maintenance culture of some international companies, inherited from its western operations and often not well-adapted to the needs of the Chinese market, can be as much a handicap as the local companies’ lack of maintenance culture. Both often result in similar inefficiencies and problems.