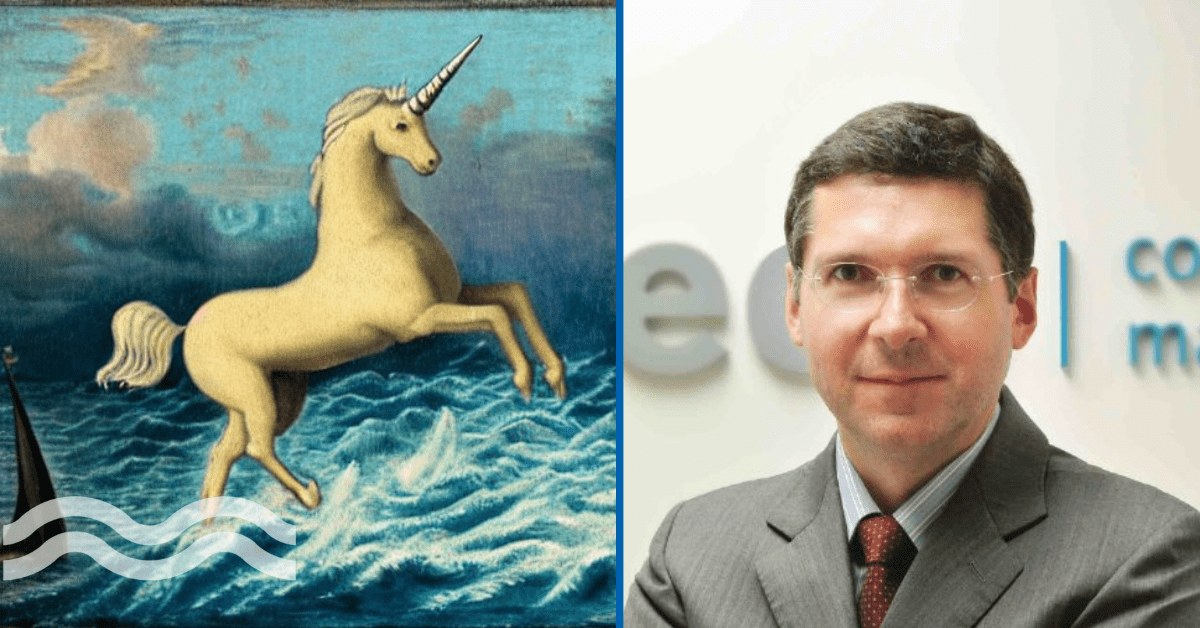

Maintenance excellence and the elusive ‘smart water unicorn’

This article, authored by Siveco China Managing Director Bruno Lhopiteau, was previously published in Aquatech, sharing the key factors driving top-tier maintenance performance within water companies across Asia.

International standards

In the lead-up to the inauguration of our Bluebee Tech office in Bangkok, Thailand, in early 2023, we collaborated with Chulalongkorn University’s School of Integrated Innovation to identify the key factors driving top-tier maintenance performance within water companies across Asia.

Students updated a large dataset originally collected for a research paper showcased at the 2019 International Water Association (IWA) conference in Hong Kong. The resulting 2023 dataset comprised 286 entities, evenly divided between Greater China and Southeast Asia.Our experts provided guidance based on experience and pertinent international standards, chiefly ISO 55000 Asset Management, ISO 14224 Collection and Exchange of Reliability and Maintenance Data for Equipment, and EN 15341 Maintenance Key Performance Indicators. A mix of traditional and machine learning techniques was employed.

What do top-tier maintenance performers have in common?

From the collaboration, we could see the top-pier maintenance performers have the following commonalities:

- They have a maintenance strategy (defined as a documented strategy that both management and technicians are aware of).

- They perceive maintenance as a risk prevention measure (directed towards preventing risks and losses, ensuring compliance with regulations, as opposed to merely repairing failures and managing direct costs).

- They leverage a computerised maintenance management system (a software system to manage technical data, work activities and maintenance plans in contrast to relying solely on paper forms and Excel spreadsheets).

- They conduct regular meetings (indicative of a structured management process).

- These meetings involve analysing historical records (as opposed to informal discussions or merely addressing immediate issues).

Any missing factor significantly diminishes performance. For instance, many companies have implemented a computerised maintenance management system (CMMS) but neglect the regular analysis of records. Consequently, their performance lags behind top-tier companies.

Diving Deeper into maintenance systems

The various maintenance systems used can be classified in four types:

- Maintenance module of an ERP System

- Dedicated off-the-shelf CMMS

- Custom-developed software (often part of a “Smart Water” platform)

- Excel and paper-based systems (not counted as CMMS in our study)

Most firms adopt a combination of the above, making it difficult to gauge how system type impacts performance. There is ample anecdotal evidence that complex overlapping systems breed frustration among maintenance teams and lead to substantial additional IT costs.

For example, a prominent water company in Hong Kong has implemented the maintenance module of its ERP to manage asset data and costs, in addition to an off-the-shelf CMMS (disparately used across different sites) for day-to-day maintenance.

Concurrently, a smart water platform was developed providing support for work requests and ‘predictive maintenance’. All systems are interfaced to varying degrees. Meanwhile, on-site teams still rely on Excel for planning and analysis and use printed forms for inspections and meter-reading records.

The quest for the elusive Smart Water Unicorn

A juxtaposition of data from 2019 and 2023 reveals a marked trend towards the adoption of ‘smart water’ platforms, custom-developed by IT departments in-house or often in collaboration with third-party software development firms. However, our data does not show a positive influence of this trend on maintenance performance.

Interviews with selected respondents reveal the main motivations behind this trend:

- Strong support from top management for digitalisation initiatives, resulting in substantial budgets

- Predictive maintenance is viewed as a key benefit of digitalisation

- A business idea to sell their software to other water companies and that the digitalisation department could evolve into a high-tech spin-off, potentially becoming the next smart water “Unicorn”- a start-up company with a value of over $1 billion.

This is beyond the scope of our study, but our experience tells us that most water companies already struggle to promote their smart water platforms within their own subsidiaries. Even global water giants that heavily invested in digitalisation and tried to sell to other water utilities have enjoyed limited success at best.

Instead, these ventures survive thanks to the mother companies’ vast captive or semi-captive market of subsidiaries and joint ventures across the globe. Furthermore, the intellectual property value of these software developments is often limited: smart water platforms largely consist of add-ons to off-the-shelf Business Intelligence tools, graphical user interfaces, alongside non-proprietary algorithms.

After years spent chasing unicorns, looking at the common success factors of top-tier maintenance performers may help water companies to reposition their smart water initiatives, improving the maintenance performance of their core operations and optimizing the value of their IT investments.

Ps. No smart water unicorns were harmed during this study.

Tags: smart water