Infrastructure owners: advice on working with Chinese builders abroad

This article is written for infrastructure or plant owners contracting with Chinese EPC companies for projects outside of China. It may also contain useful advice for EPCs (the following article is written for EPCs “For Chinese (and other) EPCs: advice on CMMS and O&M preparation for overseas projects”).

This article was previously published in Aquatech. It was written by Bruno Lhopiteau, our managing director.

New Silk Road dominance

Chinese builders have come to dominate the global infrastructure market along the “Belt and Road”, the loosely defined “New Silk Road” of infrastructure-driven development across nearly 140 countries.

They draw on the unparalleled experience acquired in their home market over the last two decades. This is a period I have been privileged to witness: my firm has been involved in Chinese construction projects in China and all over the world, learning practical lessons for foreign stakeholders.

Despite the phenomenal progress, there remains a continued perception, especially in western media, of the poor quality associated with Chinese construction. This continues, despite a 2016 study from the World Bank dispelling this misperception, showing no statistically significant difference between the quality of work of Chinese and Western firms.

What they found, however, was higher volatility from one project to another. This is also my experience. Why is that?

To fulfil the country’s huge infrastructure needs, China developed its own construction management model. In a nutshell, with the preliminary design done, the Chinese go faster into construction, not hesitating to go back to the drawing board and even allowing design changes on site.

This approach has proven successful in hundreds of mega projects; large global engineering firms have studied and learnt from it, as it often results in cost efficiency and speed. Yet, it has drawbacks.

Problems encountered during the O&M phase

China has built its ecosystem of companies and institutions, large and small, all over the country and promoted large-scale standardisation. Hence the tendency of Chinese firms to bring over all their suppliers and even sometimes workers.

In many projects, it is, however, not possible nor desirable. This leads to many of the problems observed during the O&M phase, including the following six:

- Uncontrolled changes of design, material, quick fixes applied during construction may lead to a long punch list, residual failures after start-up (often hidden thanks to quick reactive maintenance by contractors, who remain onsite during the warranty phase) and ultimately fast ageing of equipment.

- Efforts to recreate the ecosystem leads to sub-contracting in cascade: it is not uncommon for a Chinese major to subcontract all to a sister company (they all are) that brings its suppliers. This complicates communication: the lower in the chain, the less sophisticated the players and the less money available.

- Technical documentation and O&M preparation, in general, tend to be lacking. In the Chinese context, where everybody works in the same way, with a high level of standardisation, this may not be a problem. For a single wastewater plant in Uganda, it creates major headaches for the local O&M team.

- Spare parts may be difficult to obtain after the warranty period, as the foreign owner will not have privileged access to suppliers in China: lack of documentation, conflicting or absent nomenclature for spare parts is again commonly cited as a problem.

- Certain contractual requirements are often not understood, severely underbudgeted or ignored, in good faith, due to Chinese practices differing from international ones: technical documentation, maintenance instructions, spare parts lists, maintenance management systems (CMMS). The gap is often identified very late in the project and negotiated out of the scope – easily given up by the Chinese as perceived as low value, since under-budgeted.

- Smart solutions, for which China has become well-known, tend to fall into this trap. Taking the example of BIM: engineering is done in 2D. If needed, a 3D BIM model is created afterwards, often focused on visual effect. Another example is the CMMS, as the western concept differs from the Chinese “MIS” used in domestic projects, in particular in the water industry.

Using the smart solution

This state of affairs is unsatisfactory for all parties. Major Chinese builders have identified this problem, especially when competing with Korean, Japanese and western firms.

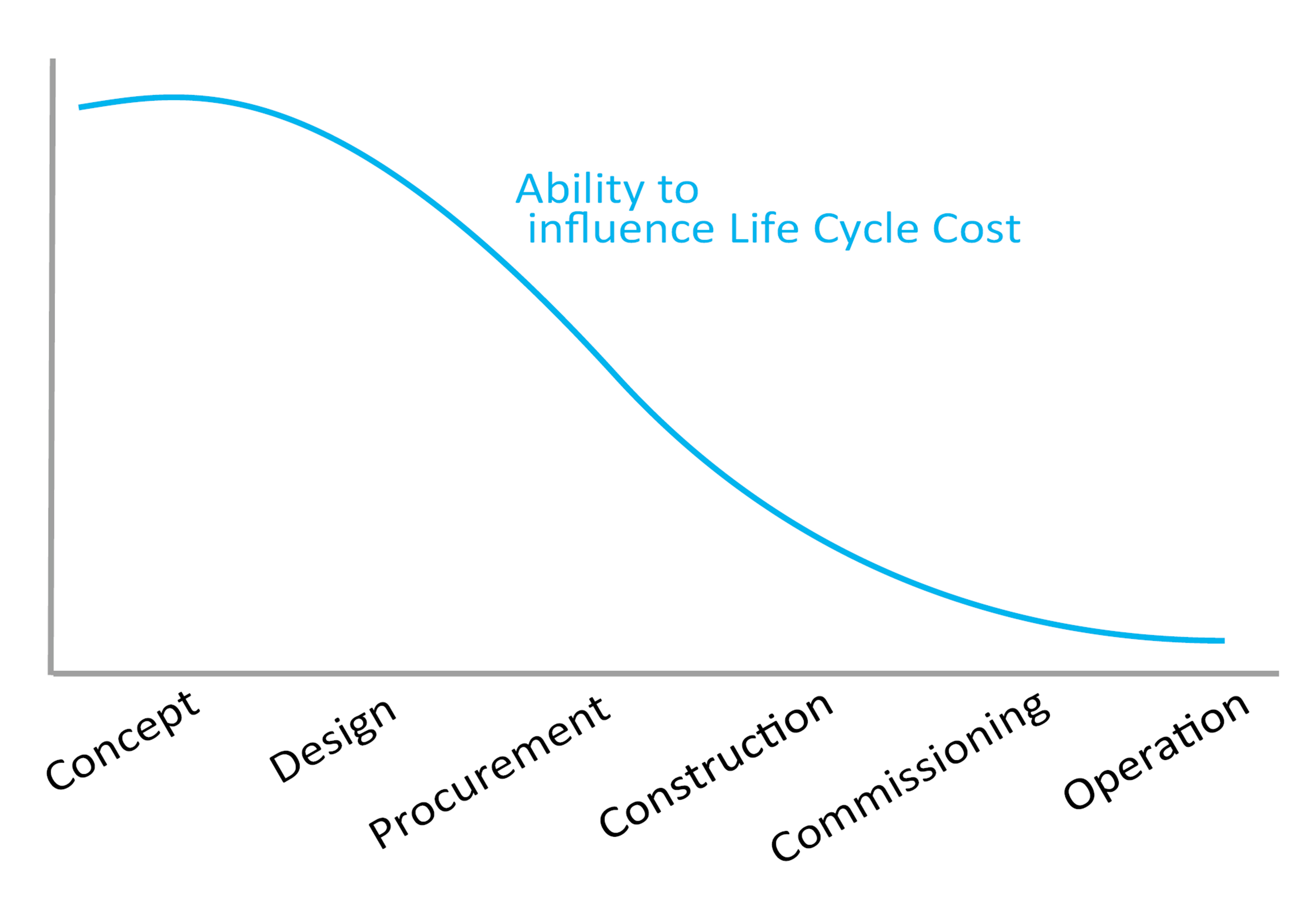

Armed with the knowledge of how and why “poor quality” or “volatile quality” occurs in Chinese projects abroad, foreign stakeholders can address them, ideally from the tendering stage.

We have seen projects where Western owner’s engineers made matters worse by creating strict contractual requirements that were simply incomprehensible from the Chinese perspective. This was mainly because the plant was in a nation much less developed than China.

Even though all terms were accepted, the Chinese later did everything wrong in the westerners’ eyes, leading to endless conflicts. How is that a solution?

Our best successes have been when we managed to talk to the foreign owner early and assisted them in adjusting the tender requirements for O&M documentation and CMMS in a way that Chinese bidders could immediately understand.

In several cases, Korean contractors were finally selected, but our efforts were not wasted!

Using the “smart solution” part of the project scope to aggregate the O&M aspects I listed in this article is an approach the Chinese will recognise and see value in if explained.