Technology-enabled technicians vs the intelligent plant, the Chinese view

This article is a based on a presentation given by Siveco China’s GM Bruno Lhopiteau at the 6th Process Industry Engineering & Maintenance Congress in Shanghai on September 6-7.

Introduction

Technological innovations, such as the use of mobile technologies, bring new opportunities to realize quick improvement in the maintenance management practice. Some of these new tools have proven particularly well-suited to the needs of the Chinese industry. Indeed, far from the “Science-Fiction” image these technologies may carry, they have already proven highly efficient in typical maintenance organizations in China, even in low-tech plants: example of immediate ROI include the “reviving” of underused maintenance management systems (CMMS, also known as “EAM”, sometimes part of the corporate ERP system). The experience of Siveco China shows that the Chinese maintenance market differs significantly from that in the West and companies operating in this country should focus more of their technological investment on people – engineers and technicians – rather than on the plant itself. Hence the title!

Maintenance “with Chinese characteristics”

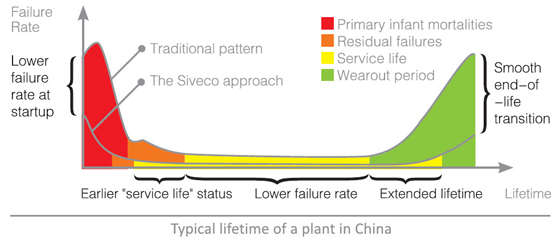

The typical plant lifecycle in China starts with construction, notably fast and cheap. Most contractors adopt a flexible “quick-fix” approach to solving problems onsite, which often results in bigger problems during operations. As a direct consequence, the residual failure rate tends to be high, which is sometimes hidden by the good reactivity of the repair teams and lack of root cause analysis i.e. nobody finds time to truly record and understand the problems. A few years down the line, the breakdown rate constantly increases, characterizing the end-of-life period. Plants tend to age much faster in China than elsewhere, leading to early replacement of equipments. As this is often hidden within larger extension projects (since most companies continue to grow their business), problems are not easy to identify and no reliable maintenance history (for example in the form of computerized records) is available to support improvement decisions. It is interesting to note that outsourcing maintenance to a third-party service supplier does not help, as more and more companies are finding out.

The market remains dominated by greenfield projects, thanks to the rapid economic development. The focus being on building “cheap and fast”, maintenance has traditionally not been a priority. Greenfield projects provide opportunities to use the latest technologies in plants, but also to prepare maintenance early; this latter opportunity is often ignored. A slowly growing awareness of maintenance can however be observed, fueled by the experience accumulated by large plant owners (MNCs with a long experience operating multiple plants in China, state-owned groups) as well as high-profile accidents that have received extensive media coverage in the past few years (the latest being elevators/escalators accidents, which investigators blamed on poor maintenance practices). The global trend for more sustainable or green factories may also have made a positive contribution, although the link with maintenance is not always understood.

As far as people are concerned, the Chinese maintenance market is characterized by a lack of understanding and practice of methodologies (acronyms like TPM or RCM may be known, but not their true meaning, even less the practices behind). Chinese engineers are generally too specialized and lack the multidisciplinary skills so crucial to manage maintenance (basic knowledge of mechanics, electricity, automation and perhaps an overall business view to understanding the impact maintenance has on the operations). Staff turnover is often listed as an issue, especially with regards to skilled personnel and management staff (including expatriate managers on assignment for 2-3 years only). The HR situation has a major impact on all aspects of the “maintenance management” discipline – all the way from fault diagnosis. While service providers (outsourcing) face the same problem as plant owners, they usually find it even harder to attract or retain people, lacking the brand name recognition of major industrial groups.

One of the great advantages of the Chinese workforce is its openness to the use of technology and perhaps even its love of new technologies. We have observed in the past 10 years that high-tech can be a powerful motivating factor: people like it, see it as a chance to learn and better themselves, and realize the company invests in them. This provides us with a great opportunity to use technology as a shortcut to implement methodologies and best practices. It is obviously a two-sided coin, the risk bring to implement technology for the sake of it, without clear improvement plan. In the context of “smart plant” and higher automation, technology has often been misunderstood as a replacing people. Unfortunately (or perhaps, fortunately) this approach almost inevitably fail, complex high-tech plants being even more reliant on skilled operators…

Some of the latest trends include a growing awareness of maintenance, clearly observable in the market, but little actual action taken (companies acknowledge they have a problem, but remain at a loss to find solutions). We see, however, continuous funding for trendy projects like “green” and “sustainability” initiatives, which are often closely related to maintenance. Due to increasing labor cost in China, companies are considering more automated production processes, leading to even more complex maintenance challenges and increasing reliance on a highly skilled workforce. In general, multinationals (plants and their suppliers) continue to try implementing Western solutions to Chinese problems, an approach that has failed over and over again, while many local companies attempt to follow the same erroneous path. Outsourcing has become a popular topic, but the focus on direct cost reduction (labor cost) and the lack of skilled resources (subcontracting firms competing for resources in a tight job market with better-known industrial companies) remain major obstacles to the successful development of this business model. In the meantime, new consumer technologies have become prevalent among employees, most notably mobile technologies – who doesn’t have a smartphone, daily access to websites, a weibo account etc.

Why most technology projects fail

The fact is that most technology projects conducted in China fail to deliver tangible results. Projects are often conducted in the same manner as in the West, although conditions are very different: the motivation for the projects, cost structures, issues, skills all greatly differ from Western markets. We at Siveco do not believe the common wisdom that China will become more similar to the West in the future, i.e. immature markets will all evolve to a perfect Western model. In fact, we strongly disagree with this idea, which is not consistent to what we observe in the field. On the contrary, we believe that China is inventing a new model for maintenance, which can perhaps even apply to the West in the future (we are already experiencing this in our export projects with Chinese construction companies building plants overseas).

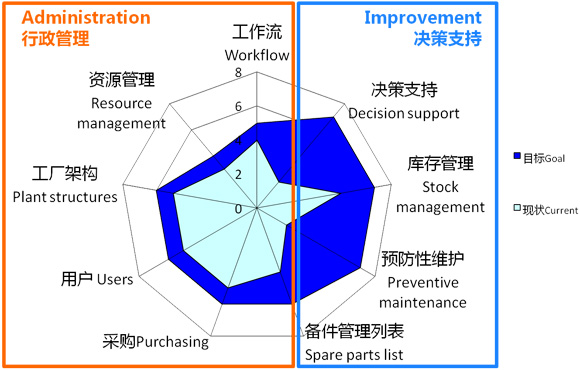

Looking more specifically at the implementation of computerized maintenance management systems, audits results show a strong focus on IT-related aspects of the projects (technical infrastructure, approval workflows of work orders etc.) which brings little or no practical benefits to the plants, while most projects are badly lacking in terms of improvement support (reliability analysis, decision support). This is mainly due to the pure IT focus of system suppliers operating in China and to projects being led by corporate IT in many companies.

IT focus i.e. focus on what IT people know (typical “EAM”)

IT focus i.e. focus on what IT people know (typical “EAM”)

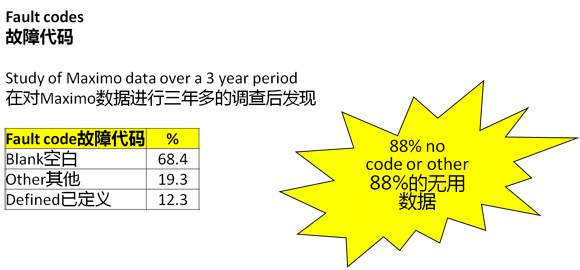

An easy-to-understand example would be the utilization of fault codes. Not always implemented, this essential functionality of a CMMS forms, together with a well-structured equipment tree, the basis for all analysis and improvement, is usually not usable due to poor coding and utilization.

Study of Maximo data over a 3 year period

Study of Maximo data over a 3 year period

Specific concerns exist for SAP projects, characterized by virtually unlimited budgets and no demand for ROI… Due to the complex nature of such projects and the lack of SAP Plant Maintenance resources in China, the implementation of SAP PM usually relies on cascading service contracts: software vendor, consulting firms, freelancers, IT departments… In such a context, many suppliers have become experts at escaping their responsibility: failures can always be blamed on someone else and ultimately on the customer’s “lack of maturity”. Based on years of experience with SAP customers, our recommendation is always: do not fight SAP, use it! Two complementary ways we know of can be considered: first of all, manage SAP projects like any other industrial projects, with ROI and clear responsibilities, often with the help of a third-party “owner’s engineer” with related skills. Second, add a “usability layer” to SAP, a piece of technology designed to facilitate output and input of data into SAP for average users. In our view, this “usability layer”, often a mobile solution interfacing to SAP, is the perfect trick to introduce the industrial team into a SAP project.

Other technologies we often assess as part of our maintenance audits include plant automation, sometimes excessive and offering little value-added, with control systems often left partly unused or even disabled. Condition monitoring systems, when not online, almost always end up with portable instruments gathering dust on a shelf, due to lack of consistent and systematic management routines. Interestingly, when those systems are integrated with the CMMS, they often send useless data (alarms and measurements that cannot be handled in the CMMS). This enormous waste of technology can be traced back to the vendor’s lack of real-life experience of maintenance in China and… the customer’s lack of maturity.

All these failures to achieve real-life improvement from projects are almost always blamed on people. We often hear plant managers complaining that their “people are no good”, “we lack of maturity”, “our engineers were not ready for this”, etc. and hoping things will get better over time (or perhaps waiting for the next job assignment).

In our view, this lack of maturity is a given, a characteristics, of the Chinese maintenance market. Vendors and customers alike need to see it as an inevitable constraint, in fact an input for any improvement projects. It should never be used as an excuse for failure – otherwise the failure rate will climb close to 100% (which is probably the case today).

A different approach: taking it upside down

This view has come to shape Siveco’s own approach to maintenance improvement. Many of our customer case studies illustrate this point.

B&G Lactic Acid, how systematic analysis helped leading lactic acid producer to quickly improve its plant reliability

This plant is the perfect example of a relatively low-tech, immature, maintenance organization and the typical “accelerated” lifecycle of a chemical plant in China, where, according to the traditional Western approach, technology would never be introduced. Instead, B&G and Siveco chose to implement a CMMS in a very practical manner to assist in fault analysis, a project which delivered reliability improvement in a relatively short time (below 6 months). More details are available in this case study.

Audits of EAM/CMMS projects in Chinese power plants

Extensive experience assessing and improving CMMS implemented in power plants, the first industry to have used such technologies in China, shows that lack of industrial experience by IT vendors has led to very disappointing results over time, namely systems serving purely administrative without any value-added in terms of improvement. A more in-depth overview of our findings can be read in this article.

Saint Gobain Pipelines, preparing maintenance from the construction stage

Saint Gobain Pipelines operates two major industrial bases in China, in Anhui Maanshan and Jiangsu Xuzhou, where it recently started operating a new highly-automated large-diameter iron piping plant. Faced with the challenge to achieve maintenance levels never achieved before in the older plants, Saint Gobain decided to implement a CMMS as a support for maintenance preparation during the construction of the plant. For more details see this month newsletter’s case study.

Lesson learnt

The conclusion is embodied in our latest bluebee® solutions for mobile workers: technology investment should be done on people and can be a powerful Trojan horse for best practices. Technicians feel good about it. It brings tangible improvement in maintenance practice, usually with ROI within a year, sometimes within weeks, for example when the mobile project allows us to “clean up” an underused CMMS database, thus reviving a previously underperforming IT investment.

More generally, we recommend clients not blindly follow Western wisdom, but instead to realize that new ways are being invented in China, where projects can often deliver much better ROI. Always beware of IT projects: industrial managers should take control of them, and use them, for example when huge SAP budgets are available.

This no-nonsense approach has delivered excellent results over the years and also echoes the experience of many industrial groups in China. It is summarized in our title: technology enabled technicians vs. the intelligent plant. People are what matters in the end.