About maintenance and CMMS market surveys

From time to time, we come across customers who have read market surveys from very famous market analysts, usually American companies such as the Gartner Group, ARC Advisory Group and the likes. These surveys used to be very popular in the “EAM” (which in IT parlance means “CMMS”, see this article for more) market, as large IT companies use the analysis reports to promote their business. Unfortunately, what we see in these reports tends to be totally out-of-line with the reality of the Chinese market. In this short article, we would like to explain why.

First of all, these market analysts tend to be extremely US-centric. Based in the United States, they go from one American conference to another, and mostly report on what happens in the US market. This is why many of the suppliers listed in those surveys are either very large US firms or very small companies not even present in the Chinese market. One of our clients investigated all the suppliers listed as “leaders” in one of the major reports: the larger suppliers, well-known IT giants, had less than 5 team members each dedicated to “EAM” in China (compared to 45 staff for Siveco China for example). The others, smaller and virtually unknown suppliers, listed as “challengers”, had no Chinese presence and employed less than 30 people globally…

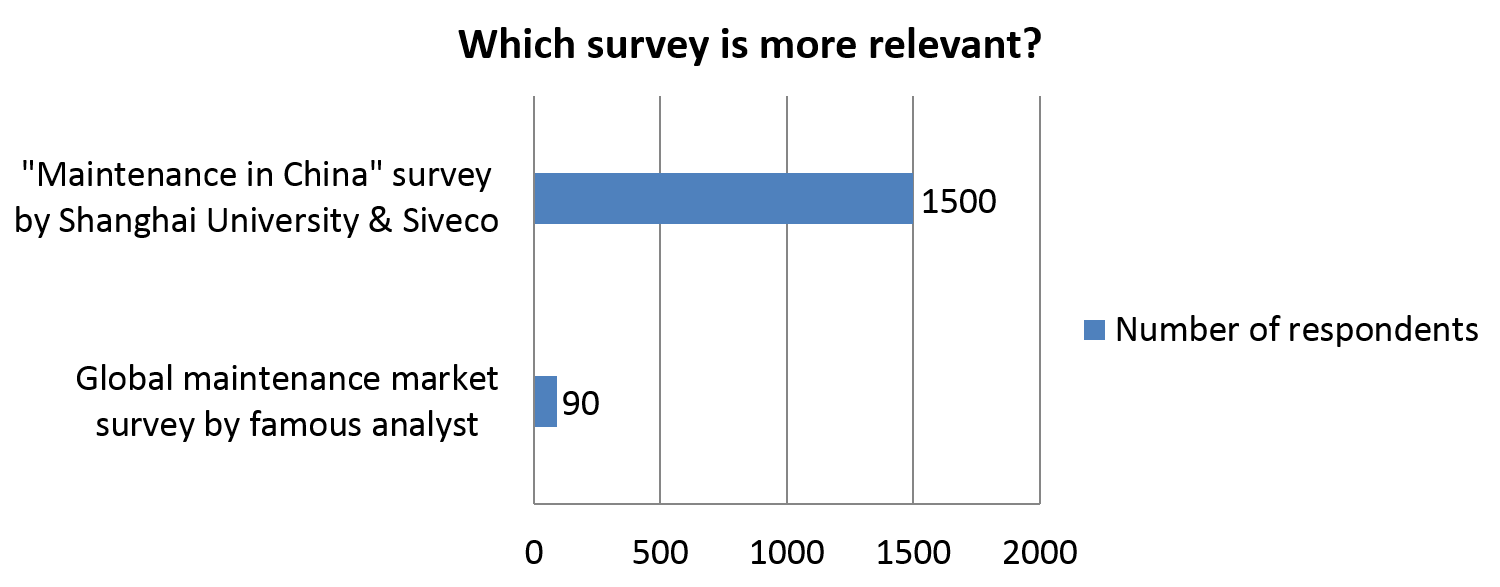

Another misunderstood aspect of these surveys, conducted by major research firms with a presumably massive audience, is the very small number of respondents… In a recent survey of EAM best practices, one sentence in the report informed readers that only 90 people or companies responded… At Siveco, we are certainly not professional market researchers, but when we ran our last “Maintenance in China” survey jointly with Shanghai University we collected about 1,500 responses… and we were worried that perhaps it wasn’t enough…!

We invite our readers to take a look at the “Maintenance in China” survey and its results. By far the largest market survey of maintenance in China, conducted by third-party team of Shanghai University with Siveco support, it gives a good, realistic view of the market, its needs and evolution. No EAM/CMMS supplier is named in the report, as this survey was not meant as advertisement, unlike sponsored US analysts’ reports.

The US-centric view and limited reach of US market survey firms dealing with maintenance systems explain their inadequacy to support decisions in China. We recommend our readers to keep this in mind when reading such reports and to take their claims or recommendations with a pinch of salt.